Liens usually attach to real estate, but they can also attach to personal property in some situations.

Liens usually attach to real estate, but they can also attach to personal property in some situations.

You ask if a property tax lien purchased at a tax sale can be "transferred" if you "pay off" the holder.

You ask if a property tax lien purchased at a tax sale can be "transferred" if you "pay off" the holder.

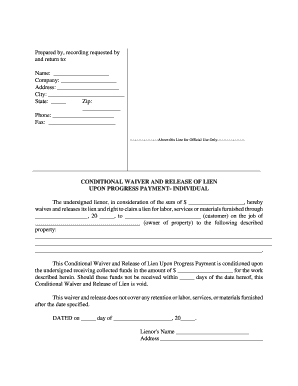

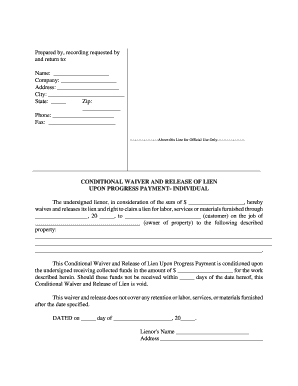

In fact, except for attorney fees for the transfer of property that may include a deed preparation fee, you can transfer real estate property to someone else with no money changing hands. If you’re worried about a lien being placed against your property without your knowledge, you can check to make sure that hasn’t happened since most property liens are public records. A lien attached to your property puts others on notice that you owe the creditor money. Generally, before a lien can be placed on a property (i.e., a real estate lien), the creditor must go to court and present evidence of the unpaid debt. The cost to transfer a deed to another person can be minimal. Transfer Of Property To Avoid A Creditor’s Lien By Stephen B. Fainsbert, Esq. A lien is like a post-it note that attaches to the taxpayer’s property. You must also have any co-owners' approval if applicable. We provide several real estate forms that can help you transfer property validly in your state. Say you’re thinking about buying a house at a sheriff's foreclosure sale. For example, you can close the sale at the bank or credit union which holds the lien on the car. Your city or county recordings office should have the information you … A release of lien discharges the lien and makes it not appear on a title policy issued for the property. A transfer of lien assigns the lien claimant's position in the lien to another party. What Types of Liens Can Be Placed Against Real Property?. Then you will sign over title to the vehicle. A lien is a claim against your property … In some cases, an attorney can transfer the lien to another one of your properties to save your home sale. A transfer of lien assigns the lien claimant's position in the lien to another party. A release of lien discharges the lien and makes it not appear on a title policy issued for the property. However, there is a judgment lien on the property, as well as the mortgage. Once you receive payment, you can immediately pay off the lien. If you don’t, you can find yourself stuck with a debt you never expected to incur. A property lien, in case you're foggy on the concept, is a public record filed against your property for unpaid debt. Finding a buyer and selling your house is a great accomplishment, especially if the real estate market is down. So, it’s critical to know what a property lien is and how to check for liens on any given property. You may not need to involve an attorney to create a particular deed if you already have all the information. A quit claim deed is often used to convey title without guarantees that the property is free of liens. This is especially true when buying auction properties, as IRS tax liens are not removed at the time of sale. According to Farmer, this is an expensive option but a bond acts as security for the lien so you can go ahead and sell the property. Before you can sell your property and give clear title to a buyer, you must pay off the lien. You will need permission of any lienholder before you can transfer the car. Assume you own a personal residence with your significant other, each of you owning a one-half interest. With a judgment in hand, a creditor can attach a lien to the property of a debtor, including any homes. The IRS’s federal tax lien can prevent taxpayers from legally transferring clear title to the property to another person. Transfers After the IRS Lien Arises Generally, anyone can transfer their property to others as they see fit. If I have restated your question correctly then the answer is "Yes," and "No." If you can’t afford to pay a lien, you can take out a bond to cover the cost. A foreclosure sale takes all of the liens off a piece of property, whether the lien exists from the mortgage or from a judgment. If there is a lien on the property title, you will need to address it as soon as possible if you intend to sell or refinance. A judgment is received, and if it is granted, the creditor can go ahead and file a lien on real estate by registering the judgment with the land records office. You learn that a third party, who obtained a judgment against you, is about to record with the county recorder a Take out a bond. A quit claim deed is often used to convey title without guarantees that the property is free of liens. How will these affect the sale? You must also have any co-owners' approval if applicable. Liens can be filed by an assortment of … When the closing process begins, you may be surprised to find several liens on the title report. If the living trust was made by a husband and wife, the creditors of either spouse can enforce liens against the property in the trust.

Liens usually attach to real estate, but they can also attach to personal property in some situations.

Liens usually attach to real estate, but they can also attach to personal property in some situations. You ask if a property tax lien purchased at a tax sale can be "transferred" if you "pay off" the holder.

You ask if a property tax lien purchased at a tax sale can be "transferred" if you "pay off" the holder.